9th General AMaMeF Conference

Paris, June 11-14, 2019

|

|

|

Program

Plenary speakers

Erhan Bayraktar (University of Michigan)

Giorgia Callegaro (University of Padova)

Giulia Di Nunno (University of Oslo)

Martin Larsson (ETH Zürich)

Johannes Muhle-Karbe (Imperial College London)

Mathieu Rosenbaum (Ecole Polytechnique)

Mihail Zervos (London School of Economics)

Johanna Ziegel (University of Bern)

Invited sessions

| Title | Organizer / speakers | Affiliation | Time | |

| Robust methods for pricing and hedging | Pietro Siorpaes | Imperial College London | Tues 10:30 | |

| Randomization in the robust superhedging duality with frictions | Matteo Burzoni | ETH Zürich | ||

| No-arbitrage with multiple-priors in discrete time | Laurence Carassus | Léonard de Vinci Pôle Universitaire | ||

| Sensitivity analysis of robust optimisation problems | Johannes Wiesel | University of Oxford | ||

| Functional data analysis in finance | Robert Stelzer | Ulm University | Tues 14:00 | |

| Non-stationary functional time series: an application to electricity supply and demand | Michael Eichler | Maastricht University | ||

| Infinite-Dimensional Time Series, Common and Idiosyncratic Components | Marco Lippi | Einaudi Institute for Economics and Finance | ||

| A space-time random field model for electricity forward prices | Florentina Paraschiv | NTNU Business School | ||

| Machine learning in finance | Rama Cont | University of Oxford | Tues 16:00 | |

| Disentangling and quantifying market participant volatility contributions | Emmanuel Bacry | Université Paris-Dauphine | ||

| Gaussian Process Regression for CVA Computations | Stéphane Crépey | Université Evry-Val-D'Essonne | ||

| Deep learning for stochastic control problems | Côme Huré | Université Paris-Diderot | ||

| Contemporary stochastic volatility modeling: high dimensional, local, rough | Christa Cuchiero | University of Vienna | Wed 10:15 | |

| Quadratic Volterra processes and multivariate stochastic (rough) volatility models | Eduardo Abi Jaber | Ecole Polytechnique | ||

| The Joint S&P 500/VIX Smile Calibration Puzzle Solved: A Dispersion-Constrained... | Julien Guyon | Bloomberg | ||

| Deep Learning Volatility | Blanka Horvath | King's College London | ||

| McKean Vlasov equations and Mean Field games in Finance | Xin Guo | University of California, Berkeley | Wed 15:00 | |

| Nonzero-sum stochastic games with impulse controls | Haoyan Cao | University of California, Berkeley | ||

| Fluctuations in finite state many player games | Asaf Cohen | University of Haifa | ||

| A neural network approach to calibration of local stochastic volatility models | Christa Cuchiero | University of Vienna | ||

| High-dimensional computations in finance | Bruno Bouchard | Université Paris-Dauphine | Thur 9:00 | |

| Computation of homogeneous martingale optimal transport via penalization … | Michael Kupper | University of Konstanz | ||

| Model-free pricing and hedging in discrete time with rough path signatures | Imanol Perez | University of Oxford | ||

| Machine Learning for PDEs | Xavier Warin | EDF R&D | ||

| Optimal transport and convex order for Finance | Gilles Pagès | Sorbonne Université | Fri 10:15 | |

| Entropic approximation of Martingale Optimal Transport and application to … | Hadrien de March | QantEv | ||

| The inverse transform martingale coupling | Benjamin Jourdain | Ecole des Ponts ParisTech | ||

| Structure of martingale transports in Banach spaces | Pietro Siorpaes | Imperial College London | ||

| Industry session: Technology and AI in Quantitative Finance | Michel Crouhy | Natixis | Thur 11:00 | |

| Machine Learning and Artificial Intelligence for Financial Markets | Charles-Albert Lehalle | CFM | ||

| Machine Learning Algorithms and Portfolio Optimization | Thierry Roncalli | Amundi | ||

| Tokens on a blockchain: a need for models | Sébastien Choukroun | PwC | ||

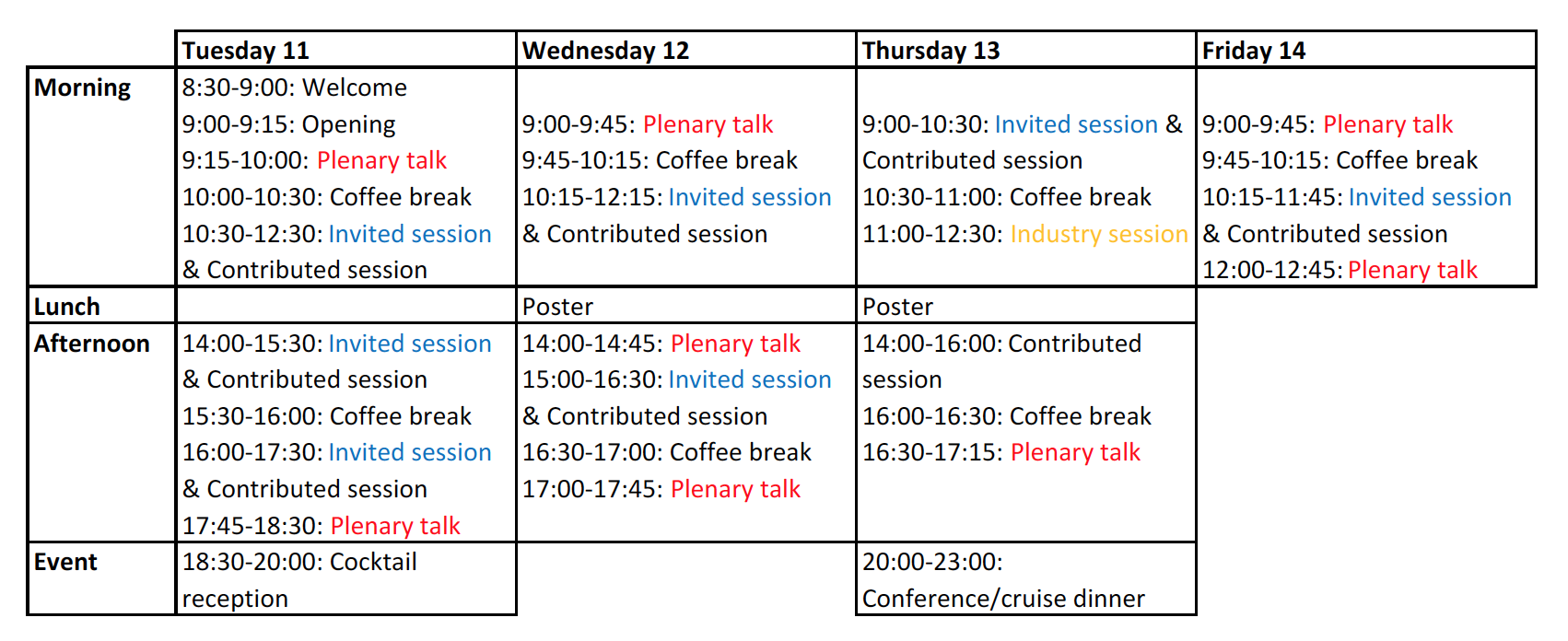

The overall schedule

Each invited or contributed talk lasts 30 minutes, discussion included.